Cryptocurrency is Harming our Planet

How Bitcoin and its digital cousins are both mining blockchain and the Earth’s natural resources

January 31, 2022

If anyone would’ve told me ten years ago that a viral dog meme would soon become the face of a form of worldwide currency, I’m not sure if I would’ve believed them. The world was crazy, but not that crazy. Yet.

Look where we are now, though. A Japanese dog breed has become synonymous with a new form of technology currently sweeping the planet with its ingenuity and novelty.

“Dogecoin” is only one example of cryptocurrency, a relatively new form of currency that is completely digital and decentralized from traditional banks or issuing companies. Rather than being issued by the bank, cryptocurrencies are created and exchanged through cryptography, in which computers run complex mathematical problems and formulas that generate the coins. This process is called “mining.” There are only a limited number of each cryptocurrency available to be mined, so these computers work around the clock to pull these pieces of code into existence.

One more popular name you might’ve heard of is “Bitcoin,” the first form of cryptocurrency to be created. From Fortune 500 CEOs to minimum wage workers, people across economic and societal demographics are flocking to Bitcoin as an opportunity to get in on huge economic gain.

Even though it was initially developed as a new way to pay for goods and services digitally, Bitcoin has become more of a gambling piece, in which people will buy and sell Bitcoin regularly, resembling a sort of stock. Since there are a limited number of Bitcoins in circulation, their value decreases and increases due to rules of supply and demand, just like any other commodity used by the general public. The value of Bitcoin reached its highest peak to date in April of 2021, with one Bitcoin equaling more than $63,000.

While these new economic systems seem utopian for anyone looking to invest for a quick buck, there are other repercussions to consider. One study claims that emissions from Bitcoin transactions could singlehandedly increase the Earth’s temperature by 2°C.

One might pose the question: how does a digital currency with no physical trace leave behind such a large environmental footprint?

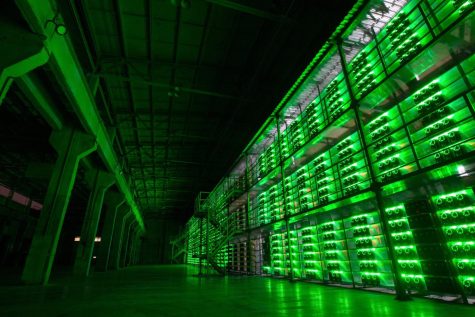

In order for cryptocurrency to be generated, many computers work to compute mathematical equations and problems. Every transaction that takes place in Bitcoin also has to be recorded in large computational systems to account for all the currency being exchanged and created. These actions take large amounts of electricity to carry out. Bitcoin alone uses over 204 terawatts of electricity, with one terawatt equating to one trillion watts of energy. This amount is more than the annual electrical power used by Thailand. The electrical energy used by a single Bitcoin transaction is equivalent to the energy consumption of the average American household over the span of 73.9 days.

The annual carbon footprint of Bitcoin produces about 97 million tons of carbon dioxide, which is equivalent to the carbon footprint of Kuwait. In recent years, the gold mining industry is actually emitting less CO2 annually than Bitcoin. Recent research proposes that for every $1 Bitcoin produces in value, $0.49 has to be spent to repair its damages to public and environmental health.

The Bitcoin industry is also taking advantage of vulnerable and low-income communities and countries, further increasing the divide between over exploited and overdeveloped nations across the board.

As the set number of Bitcoin in circulation continues to increase, with less Bitcoin available to mine over time (all Bitcoin is projected to be mined by 2140), more powerful technology is needed to crack the cryptographic codes to generate it. As a result, Bitcoin miners have learned to take advantage of nations in which electricity and power are cheaper and easier to come by. In some cases, Bitcoin miners are competing with inhabitants for resources in underdeveloped regions, such as in the Democratic Republic of Congo, in which foreign Bitcoin mines were established in EU-backed plants originally made for native civilians to have easy access to energy. When cryptocurrency mines are being placed on abandoned ex-Soviet lands, it’s hard to say that there aren’t targets placed on the backs of impoverished, developing nations.

Even though the technology used to circulate Bitcoin consists of extremely complex, expensive systems, these pieces of technology run tirelessly, becoming obsolete in the span of months. Electronics constantly have to be discarded and replaced. These discarded systems become electronic waste, commonly deemed as “e-waste.” Discarded Bitcoin technologies alone produced 30.7 kilotons of e-waste in 2021.

Where does this “e-waste” go, exactly?

E-waste is disproportionately finding its way in territories and on coasts of developing nations. Since these countries have little to no regulations regarding toxic waste management, developed nations are sending 23% of their electronic waste to developing countries annually. Another study looking at the U.S. specifically found that 39% of the nation’s e-waste is exported to other countries. Since this problem of electronic waste is relatively new, there are a lack of rules and regulations regarding where e-waste should be redirected and dealt with. This lack of awareness and legislation surrounding the phenomenon also creates concerns of public safety in these exploited countries, with workers in environments extremely harmful to their health and longevity.

It’s not hard to see how the world of cryptocurrency is harming the world around it, but even with this readily available information, the Bitcoin craze isn’t going to die down anytime soon. It’s proving to be too much of a valuable resource for people across the world.

What can be done?

There are already a few initiatives working to break down the harm of cryptocurrencies. One example is the newly-founded Crypto Climate Accord, its partner companies pledging to reach “net zero” emissions by the year 2040. Outside of communal organizations, there are also private organizations that invest in companies who participate in carbon offsetting, providing financial incentive for becoming environmentally conscious. One example of this is Gemini Green, which has already offset 341 thousand tons of carbon emissions.

Even with Bitcoin and cryptocurrency’s large environmental impact, there are concerned consumers and companies on the other side ready to combat it with future legislation and action. Time will tell if these efforts will be enough to curb the damage the industry is doing to the world around us.